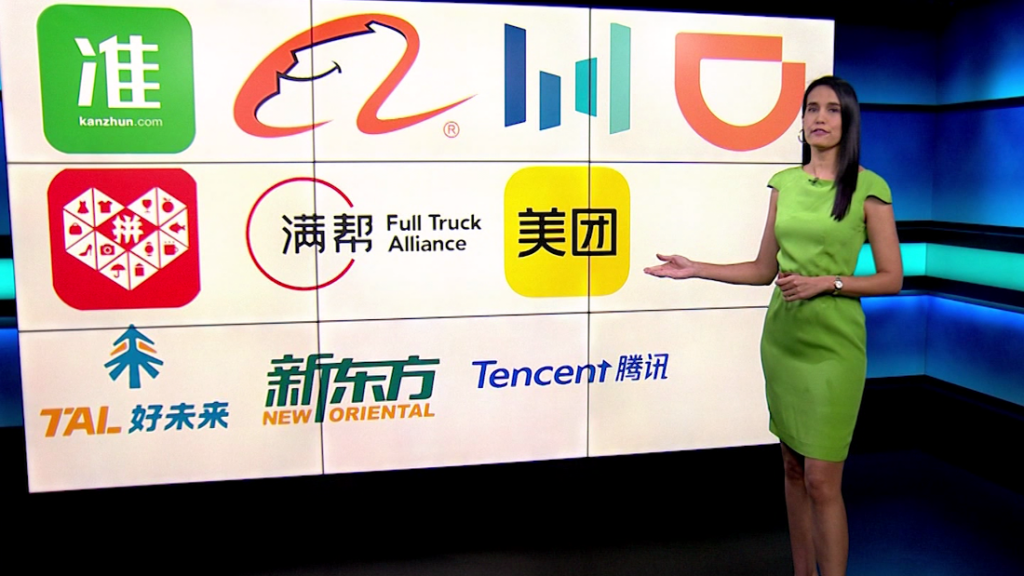

China’s ‘revolution’ cost investors $3 trillion. So why aren’t they running scared?

Even as authorities rip up the status quo for tech, education and other private enterprise, drawing comparisons with Mao Zedong’s Cultural Revolution in the process, some of the biggest names in asset management say it’s still a good time to invest. They say recent regulatory moves were necessary and overdue, and China’s growth story remained attractive.”The case for China in the long-term is intact,” said Luca Paolini, chief strategist for Pictet Asset Management. The firm is an arm of Swiss private bank Pictet Group, which has Beijing has signaled that its get-tough approach will BlackRock’s strategists echoed that rationale, writing that the Chinese leadership sees the measures as “necessary to rein in the industries that have been rapidly growing and lightly regulated.””We stand by our strategic preference for Chinese assets,” they added.Even Goldman Sachs — which recently estimated that the crackdown had wiped out $3.1 trillion in market value for Chinese companies world wide, half of that from tech firms alone — has remained bullish.Strategists at the investment bank wrote last week that the “uncertain trading environment” wasn’t likely to hurt the case for buying Chinese equities too much, at least not in the mainland. Companies that list overseas may be in for a rougher time, as US and Chinese regulators alike have been squeezing firms that list in New York. Even then, though, the Goldman analysts pointed to “long-term value” for those companies — they just want to “wait for more regulation clarity” first.China has “strong economic and earnings growth potential in a global context,” the strategists wrote.The bank acknowledged in a July research note that stocks have taken a significant hit from the crackdown, adding that some of its clients have even asked whether Chinese markets have become “uninvestable.” But they said they believe it’s unlikely that “extreme regulations” would spread to every sector.The government has supported the development of “foundational technologies,” such as renewable energy and 5G networks, and “would be pragmatic when striking a balance between social/ideological goals and capital markets in non-social sensitive industries over time.”The “indiscriminate” sell-off has also created some bargain investments for those thinking longer term, according to Victoria Mio, director of Asian Equities at Fidelity International.”Despite policy headwinds in some sectors, China is still on track for decent GDP growth over the next decade,” she said, pointing to increasing purchasing power by the middle class.Some firms also touted the value of other Chinese assets.Paolini pointed out that the yuan has performed better than other major currencies this year, up 1% against the US dollar. Chinese government bonds are also overperformers, returning 3.5% compared to a 1.1% loss on JP Morgan’s global government bond index, a benchmark tracked by bond investors.”Clearly, China remains fully ‘investable’ for foreign investors,” he added.Caution is still neededThe Goldman analysts said, though, that any investment needs to be tactical. Media, consumer services, education, retail, transportation and biotech could be at risk of further regulatory backlash, they added, given Beijing’s focus on solving what it sees as social or cultural issues caused by those industries.”It’s difficult to predict the future direction of policy changes, but avoiding stocks and sectors where valuations are rich and … expectations [are high] can help mitigate this uncertainty,” said Catherine Yeung, investment director at Fidelity International. She added that investors have left internet and education stocks, instead investing in sportswear and renewables, among other industries.”There have always been social and economic imbalances, and the pandemic has brought these to light even more,” she added. “China’s recent policy/regulation changes are set up to address these imbalances with a focus on security, autonomy and fairness.”— Kristie Lu Stout and Jadyn Sham contributed to this article.