China may be getting ready to wind down its crackdown on big tech

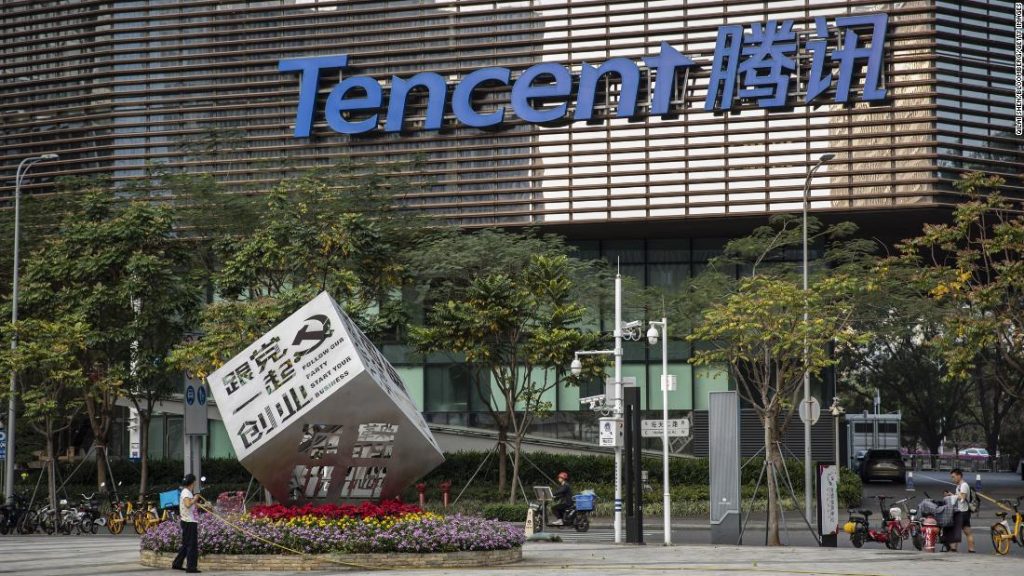

Hong Kong’s Hang Seng index jumped 4%, while the Shanghai Composite was up 2.4%, after Chinese state media reported that the country’s top leaders had vowed to boost growth. They also promised to “promote the healthy development” of the internet economy and “introduce specific measures” to support the sector, the Communist Party’s Politburo said Friday, according to state-run Xinhua News Agency. The pledge follows a sweeping crackdown on some of the country’s biggest private enterprises that began in 2020 when the government slammed the brakes on Ant Group’s plan to go public at the last minute. Analysts took Friday’s statement as a sign that the government may dial back its dramatic regulatory offensive, which has slammed industries ranging from tech and finance to gaming, entertainment and private education.”In short, today’s Politburo meeting wants to assure the market that the regulation campaign, which started from the end of 2020, is over,” said analysts at Macquarie Capital on Friday. Tech stocks rose sharply in Asia with the Hang Seng Tech Index soaring 10% in Hong Kong. Alibaba (BABA) was up more than 15%, while Tencent (TCEHY) gained over 11%. The Communist Party meeting comes as strict Covid restrictions in China have battered its stock markets and currency, and investors are growing increasingly pessimistic about the impact of lockdowns on the world’s second biggest economy.Beijing is rattledChina’s leadership is clearly concerned about the slowdown. This is at least the second time this week that it has pledged to fix the economy. In a meeting on Tuesday, President Xi Jinping said that the country will embark on an infrastructure spending spree to increase domestic demand and promote growth.Although markets were upbeat Friday, analysts want to see specific policies laid out. “The economy is in trouble, with second quarter GDP growth likely turning negative year-on-year. A significant change of macro policy is necessary to turn the economy around,” said Zhiwei Zhang, president and chief economist at Pinpoint Asset Management.”We will observe the actions from the government in the next few weeks and update our view accordingly,” he added.A number of investment banks have slashed their forecasts for Chinese growth in the past month. And the International Monetary Fund last week said it expected growth of 4.4% this year, down from a previous forecast of 4.8%, citing risks from Beijing’s strict zero Covid policy. This is well below China’s official forecast of around 5.5%.— Laura He in Hong Kong and the Beijing bureau contributed to this report.